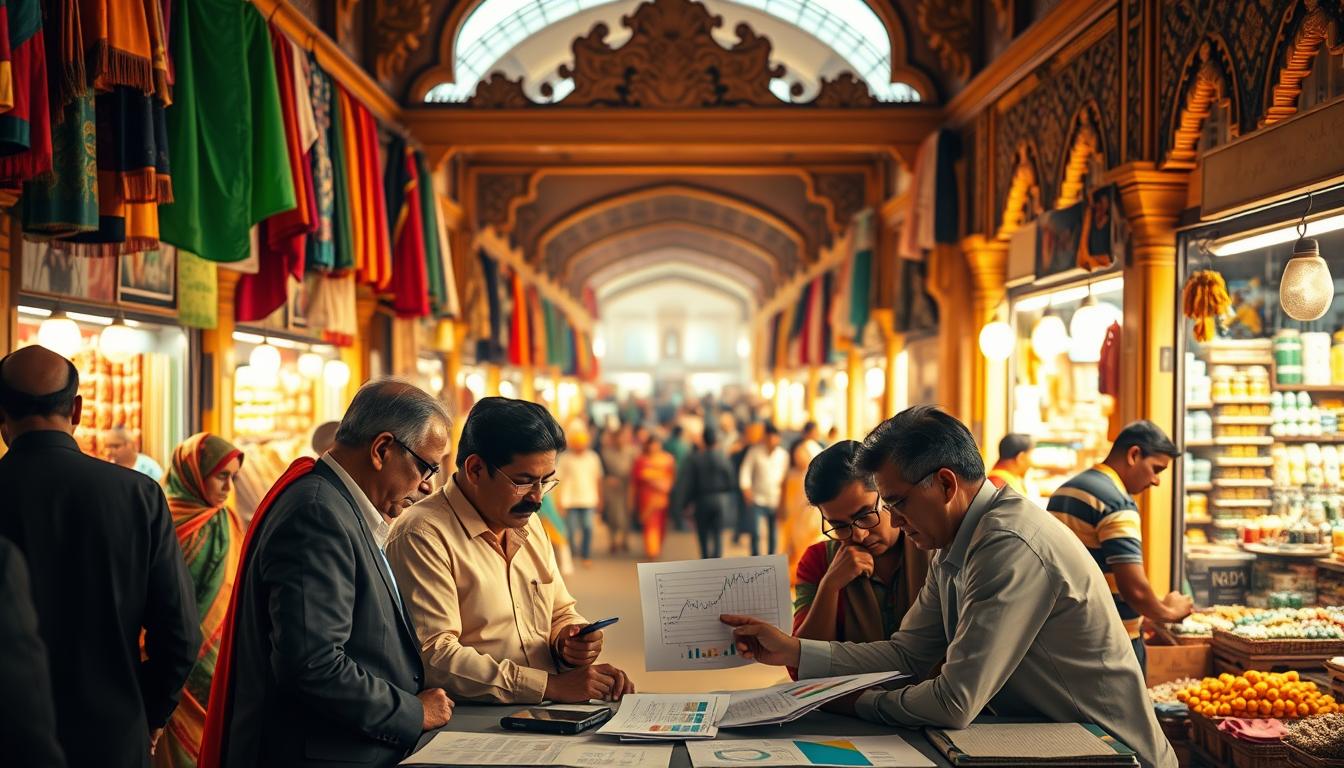

The Indian stock market is going through a tough time. The Nifty fell below important levels last week. Analysts warn of a cautious short-term outlook due to weak global signals and poor earnings.

How do global events impact Nifty & Bank Nifty in 2025? The current market situation is heavily influenced by global trends. The Indian market shows the same volatility seen in international markets.

Our weekly technical outlook gives insights into the Indian stock market. It includes support-resistance levels and FII flow trackers.

Key Takeaways

- Global trends are significantly impacting the Indian stock market.

- Nifty and Bank Nifty are under pressure due to weak global cues.

- Technical analysis indicates a cautious short-term outlook.

- FII flows are being closely monitored for market direction.

- Support and resistance levels are key for understanding market movements.

Bookmark this page for weekly expert outlooks—have a question? Comment below!

The Significance of Market Predictions in India’s Economic Landscape

Accurate market predictions are key for smart investment in India’s fast stock market. As India’s economy grows, knowing market trends and making good predictions is vital for investors.

Understanding Nifty and Bank Nifty Indices

The Nifty 50 and Bank Nifty are major indices in India’s stock market. The Nifty 50, with 50 large-cap stocks, shows the market’s mood. The Bank Nifty, focusing on banks, tells us about the financial sector’s health. These indices are important for investors, giving a quick view of the market’s state.

India’s derivatives market has grown a lot, with more liquidity and volatility. This gives investors more chances to make money. The Nifty 50 and Bank Nifty are at the center of this market, with everyone watching their performance.

Why Technical Analysis Matters for Indian Investors

Technical analysis is a key tool for Indian investors. It helps them make smart choices based on past market data and trends. By looking at charts and technical indicators like RSI and MACD, investors can spot good times to buy or sell, manage risks, and improve their strategies.

Technical indicators for Nifty are very important for predicting market moves. Investors use these indicators to understand market feelings and predict future trends. With the nifty50 prediction2025 and bank nifty forecast nse india being watched closely, technical analysis offers valuable insights that can greatly impact investment results.

Keeping up with the latest Indian stock market news July 2025 is also key for investors. It helps understand market movements and aids in making smart choices.

Nifty Prediction 2025 Bank Nifty Outlook July 2025 Indian Stock Market Weekly Technical Analysis

Let’s explore the technical analysis of Nifty and Bank Nifty. It’s key to understand the current market and its future in 2025.

Current Market Positioning

The Nifty has recently dropped below its 20-day moving average (25,265). This shows a weakening trend. It’s now close to a key support area between 25,088 and 25,000.

This area is important because it has been a strong support zone before. Investors are now cautious, waiting to see what happens next.

Key Technical Indicators Shaping the Outlook

Several technical indicators are influencing Nifty and Bank Nifty’s outlook. These include:

- Relative Strength Index (RSI): The RSI is near the neutral zone, showing a balance between positive and negative forces.

- Moving Average Convergence Divergence (MACD): The MACD shows a bearish crossover, hinting at a possible downturn.

- Moving Averages: The 50-day and 200-day moving averages are key for the long-term trend. The Nifty is below the 50-day average, pointing to a short-term downtrend.

| Indicator | Current Value | Implication |

|---|---|---|

| RSI | Neutral Zone | Balance between bullish and bearish forces |

| MACD | Bearish Crossover | Potential downside risk |

| 50-DMA | Below 50-DMA | Short-term downtrend |

Weekly Candlestick Patterns and Their Implications

The weekly candlestick pattern for Nifty shows a bearish engulfing pattern. This indicates possible selling pressure. Bank Nifty’s pattern is also bearish, with a dark cloud cover forming, hinting at a reversal.

These patterns, along with the technical indicators, suggest caution in the short term. But, the support cluster around 25,000-25,088 might offer a chance for a rebound.

Decoding Nifty’s Technical Chart Patterns

Technical chart analysis of Nifty helps investors understand market trends. It shows how the market might move. By looking at technical indicators, investors can make better choices in the Indian stock market.

Support and Resistance Levels for Nifty

Support and resistance levels are key in Nifty’s chart patterns. They show where the market has trouble moving past or below. Right now, Nifty’s support is at 22,000 and resistance at 23,500. Breaking these levels can mean big changes in the market.

Momentum Indicators: RSI and MACD Analysis

Momentum indicators like RSI and MACD help see market trends. The RSI has dropped below 20, showing oversold readings. This might mean the market is ready to bounce back. The MACD shows a bearish crossover, hinting at a downward trend.

“The key to successful investing is to buy when the RSI is oversold and sell when it’s overbought,” said a renowned market analyst.

Moving Average Trends: 50DMA and 200DMA

Moving averages, like the 50DMA and 200DMA, are important for Nifty’s trend. Nifty is above its 50DMA, showing a short-term bullish trend. But, it’s below the 200DMA, meaning the long-term trend is bearish. Investors watch these crossovers for big market shifts.

By studying these patterns, investors can better understand Nifty’s movements. This helps them make smarter investment choices.

Bank Nifty Technical Analysis: Navigating Financial Sector Movements

Bank Nifty technical analysis helps us understand the banking sector’s performance and future trends. The Bank Nifty index is key for India’s banking sector. Investors and traders watch it closely.

Critical Support and Resistance Zones

For Bank Nifty, strong support is around 24,500–24,800 levels. This area has been a key floor for the index. The target is 26,000 in 6–12 months, showing growth.

Key Support Levels:

- 24,500

- 24,800

Key Resistance Levels:

- 25,500

- 26,000

Volume Analysis and Price Action

Volume analysis is key in Bank Nifty technical analysis. More volume with price rise means a strong trend. Less volume with price fall means a weak trend.

Traders watch Bank Nifty’s price action for patterns. Patterns like head and shoulders and double tops are important.

Bullish vs Bearish Indicators for Banking Stocks

Several indicators show how banking stocks are doing. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are key.

Bullish Indicators:

- RSI below 30 followed by a rise above 30

- MACD crossover above the signal line

Bearish Indicators:

- RSI above 70 followed by a drop below 70

- MACD crossover below the signal line

Global Economic Trends Shaping Indian Market Trajectory

India’s economy is closely linked to the global market. Trends in the US, Europe, and Asia greatly affect its market path. It’s vital for investors to keep up with global economic news.

US Federal Reserve Policy Impact

The US Federal Reserve’s policies have big effects on global markets, including India. Changes in interest rates can change capital flows. This can impact the Indian rupee’s value and the appeal of Indian stocks to foreign investors.

A recent financial analysis noted, “The Fed’s policy decisions are closely watched by investors worldwide, as they can significantly impact global liquidity and investment flows.” A dovish stance by the Fed can lead to increased investment in emerging markets like India, while a hawkish stance may result in capital outflows.

European Markets and Their Influence

European markets also shape India’s market path. The European Union is a key trading partner for India. Economic changes in Europe can affect Indian exports and the performance of companies with European ties.

Trade agreements and economic policies in Europe can either boost or hinder India’s economic growth, depending on their nature and scope.

A market expert noted, “The interconnectedness of global markets means that economic trends in one region can have ripple effects elsewhere.” European market trends can influence investor sentiment globally, including in India.

Asian Markets: China’s Growth Story and Regional Dynamics

China’s growth story is a key factor for India’s market. As a major Asian economic power, China’s policies and growth have big implications for regional trade and investment. India’s competition with China in various sectors, including technology and manufacturing, means that China’s growth can have both direct and indirect impacts on India’s economic prospects.

The dynamics within Asian markets, including the growth stories of other regional economies, also shape India’s market outlook. Regional trade agreements and economic cooperation initiatives can further integrate India’s economy with its Asian neighbors, potentially boosting growth prospects.

In conclusion, the Indian market’s trajectory is influenced by a complex interplay of global economic trends. Understanding these trends, including the impact of US Federal Reserve policy, European market developments, and Asian regional dynamics, is key for investors looking to navigate India’s markets effectively.

Commodity Markets and Their Influence on Indian Equities

Commodity markets are key in shaping Indian equities. Global price changes affect many sectors in India.

Crude Oil Price Movements and Energy Sector Implications

Crude oil prices greatly impact India’s energy sector. Being a big oil importer, India’s energy costs are tied to global prices. Rising oil prices can increase business costs, affecting profits. Lower oil prices can help the economy by cutting energy costs.

“The energy sector’s success depends on crude oil prices,” notes a market expert. These prices affect the sector’s profits and influence government policies and consumer choices.

Precious Metals: Gold and Silver Trends

Precious metals like gold and silver are safe investments. Trends in these metals show investor mood and economic stability. When the economy is shaky, investors buy gold and silver, pushing prices up.

- Gold prices change with global economic conditions, inflation, and currency shifts.

- Silver, being more volatile, sees big price swings due to industrial demand and investor mood.

Agricultural Commodities and FMCG Sector Outlook

Agricultural commodities directly affect the FMCG sector. Price changes in these commodities can hurt FMCG profits. For example, higher wheat prices can raise food company costs, leading to higher prices for consumers.

The FMCG sector’s future depends on agricultural commodity trends. Investors should watch these trends to predict impacts on FMCG stocks.

Foreign Institutional Investors: Flow Analysis and Impact

Foreign institutional investors are key players in India’s financial scene. Their flow analysis is vital. Recent FII activity trends have big implications for the Indian stock market.

Recent FII Buying and Selling Patterns

FIIs have been buying into the Indian market, focusing on large-cap and mid-cap stocks. Data shows FIIs and DIIs are now buying again. They’re focusing on real estate, banking, and auto sectors, thanks to the RBI’s rate cut.

“The RBI’s accommodative monetary policy has been a key driver of FII inflows into India.” Market analysts agree. They say favorable policies attract foreign investment.

Correlation Between FII Activity and Index Movements

FII activity closely matches the movements of key indices like Nifty and Bank Nifty. Buying by FIIs pushes indices up. Selling leads to a downturn.

- FII inflows increase market liquidity, boosting stock prices.

- Outflows decrease liquidity, causing stock prices to fall.

- Domestic investment trends also affect this correlation.

Domestic vs Foreign Investment Trends

The mix of domestic and foreign investments is complex. FIIs bring in foreign capital. DIIs provide stability with their long-term view.

“The balance between FII and DII flows is key for market stability. FIIs’ volatile decisions are balanced by DIIs’ steady investments.”

Grasping these dynamics is vital for investors in the Indian stock market.

Sector-wise Market Predictions for 2025

2025 is expected to bring new chances and challenges for India’s main sectors. These include IT, pharmaceuticals, banking, and infrastructure. Knowing these market predictions is key for investors and stakeholders.

IT Sector: Digital Transformation and Global Demand

The IT sector is set for big growth in 2025. This is thanks to the digital change happening across industries. Global demand for IT services is expected to go up, focusing on cloud computing, cybersecurity, and data analytics.

Experts say, “The digital revolution is far from over, and Indian IT companies are well-positioned to capitalize on this trend.”

Indian IT firms will see more demand for AI and IoT. This could make IT stocks look good in 2025.

Pharmaceutical Industry: Innovation and Export Growth

The pharmaceutical industry in India is set to grow in 2025. This growth comes from innovation and export growth. Indian pharmaceutical companies will benefit from a strong pipeline of new drugs and global demand.

As

“India’s pharmaceutical sector is one of the largest globally, and its exports are expected to grow significantly in the coming years,”

an industry report says. This growth is due to cost competitiveness and a favorable regulatory environment.

Banking and Financial Services Outlook

The banking and financial services sector in India is expected to do well in 2025. This is thanks to increasing credit demand and digitalization. The government’s focus on financial inclusion and digital banking will drive growth.

Sectors like banking and financials are showing strong growth. Banking stands out with a big increase in Put Open Interest. This suggests growth in the banking sector.

Infrastructure and Manufacturing Sector Prospects

The infrastructure and manufacturing sectors are expected to grow in 2025. This growth comes from government initiatives and investments. The focus on infrastructure development and the ‘Make in India’ initiative will help these sectors expand.

- Increased government spending on infrastructure projects

- Growing demand for manufactured goods

- Improvement in ease of doing business

2025 looks promising for India’s key sectors. There are many opportunities and challenges ahead. Investors and stakeholders need to stay informed to navigate this dynamic landscape effectively.

Geopolitical Factors Influencing Indian Market Sentiment

India’s economy is growing fast. But, things like regional conflicts and trade relations with other countries affect the market. The Indian market is linked to the world’s economy, making it sensitive to global tensions.

Election Impacts on Market Stability

Elections in India can make the market shake. Investors wait to see what policies will be made. Until then, they hold back, watching the election results.

Market stability is key during elections. It affects how confident investors feel. If the new government’s policies are good, the market can do well.

International Trade Relations and Policies

India’s trade with other countries affects its market. Deals or disagreements can change how different sectors do.

- Good trade deals can help exports grow, making the market better.

- But, trade fights can make imports cost more, hurting the market mood.

Investors keep an eye on India’s trade policies. They see how these policies help or hurt Indian businesses worldwide.

Regional Conflicts and Their Economic Consequences

Regional fights, big or small, can hurt the Indian market. They can change prices of goods, the value of money, and how investors feel.

For example, problems in the Middle East can make oil prices jump. This can raise India’s import costs and cause inflation. Tensions with neighbors can also mess with local trade and peace.

In short, global politics greatly shape the Indian market’s mood. Knowing this helps investors make smart choices.

Expert Commentary: Insights from Top Indian Market Analysts

Leading Indian market analysts offer valuable insights on the market’s future. They focus on the Nifty and Bank Nifty indices. Their views help us understand the market’s path ahead.

Brokerage House Forecasts

Brokerage houses are upbeat about the Indian market. They predict a positive trend for the Nifty and Bank Nifty indices. Dr. Ravi Singh, a well-known analyst, believes, “The derivatives market will shape the Indian stock market’s future.”

Some key forecasts include:

- A surge in the Nifty index to new heights

- Increased volatility in the Bank Nifty index due to global trends

- A shift towards better risk management strategies

Independent Analyst Perspectives

Independent analysts also share their views. Rajiv Batra points out India’s economic growth prospects. “India’s growth will continue, driven by infrastructure and digital transformation,” he says.

Some key points from independent analysts are:

- Monitoring global trends and their impact on India

- Growth in IT and pharmaceutical sectors

- The need to stay informed and adapt to market changes

Contrarian Views Worth Considering

While many are optimistic, there are also cautionary views. Experts warn of global downturns and geopolitical tensions.

“Investors should be cautious and diversify to mitigate risks,” a contrarian analyst advises.

Investment Strategies for Navigating Market Volatility

In today’s fast-paced financial markets, having a sound investment strategy is key. It helps you manage risk and find opportunities. Investors can use different strategies to do this.

Short-term Trading Approaches

Short-term trading means buying and selling securities quickly, often in days or weeks. It needs a good understanding of market trends and technical analysis.

- Use technical indicators like RSI and MACD to spot good times to buy or sell.

- Keep an eye on market news and events that might change stock prices.

- Set clear profit and loss goals to control risk.

A market expert says, “Being quick to adapt to market changes is key to short-term trading success.”

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” – Philip Fisher

Medium to Long-term Investment Perspectives

Investors with a longer view often find success in fundamental analysis. This method looks at the true value of investments. It means buying and selling less often, which saves on costs.

| Investment Type | Time Horizon | Risk Level |

|---|---|---|

| Stocks | 5+ years | High |

| Bonds | 2-10 years | Low to Medium |

| Mutual Funds | 3-7 years | Medium to High |

Risk Management Techniques for Uncertain Markets

Managing risk well is essential for getting through tough market times. Techniques include diversifying, hedging, and rebalancing your portfolio.

Diversification spreads investments across different types to lower risk. Hedging uses special financial tools to protect against losses. Regular portfolio rebalancing keeps your investments in line with your risk level and goals.

By using these strategies, investors can handle the ups and downs of volatile markets. They can work towards their financial goals.

Nifty Above 25,000: Sustainability and Future Trajectory

The Nifty’s recent jump above 25,000 has caught everyone’s attention. Investors and analysts are keenly watching. They’re looking at several key factors to see if this milestone can last.

Historical Perspective on Index Milestones

The Nifty has shown steady growth and resilience over time. It has hit many milestones. Looking at these past achievements can give us clues about its future.

- The Nifty has always moved up, with some dips along the way.

- When it hit 10,000 and 20,000, it kept growing.

- By studying past trends, we can predict its future growth.

Fundamental Factors Supporting Higher Valuations

Several key factors are behind the Nifty’s high valuations. These include:

- Economic Growth: India’s economic reforms and growth plans are positive.

- Corporate Earnings: Good earnings reports have driven the Nifty’s rise.

- Investment Flows: Both foreign and domestic investments are boosting the market.

Potential Challenges to Sustained Growth

Despite the good signs, there are challenges ahead:

- Global economic issues like trade wars and conflicts.

- Changes in India’s economic policies and regulations.

- Market ups and downs due to global and local events.

Investor Sentiment at Psychological Barriers

When the Nifty hits big numbers like 25,000, how investors feel matters a lot. It’s key to understanding market moves.

As the Nifty stays above 25,000, keeping an eye on these factors is vital. It helps investors make smart choices.

Conclusion: Navigating India’s Market Future in a Global Context

India’s market is changing fast, and knowing about Nifty and Bank Nifty is key for investors. The world’s economy, politics, and India’s own issues will guide its market path.

To succeed in India’s market, you need to look at both technical and fundamental aspects. Global trends, commodity prices, and foreign investors will keep affecting India’s market.

Investors should keep up with market forecasts, global politics, and expert views. This knowledge helps them make smart choices in India’s market.

As India’s market expands, staying updated on trends and analysis is vital. A well-informed strategy can help investors take advantage of India’s dynamic market.

FAQ

What are the key factors influencing Nifty and Bank Nifty in 2025?

Several factors will shape Nifty and Bank Nifty in 2025. These include global economic trends and US Federal Reserve policy. Also, European and Asian markets, commodity prices, and foreign investor actions will play a role.

How does technical analysis help Indian investors?

Technical analysis offers insights into market trends. It helps identify support and resistance levels. This way, investors can make informed decisions.

What are the critical support and resistance levels for Nifty?

To find Nifty’s support and resistance levels, look at technical charts. Patterns like moving averages, RSI, and MACD are key. They show where prices might move.

How do global economic trends impact the Indian stock market?

Global trends, like US Federal Reserve policy changes, affect the Indian market. So do European and Asian market shifts. These trends sway investor mood and market stability.

What is the outlook for the banking sector in 2025?

The banking sector’s future in 2025 hinges on interest rates, credit growth, and asset quality. Technical analysis of Bank Nifty can spot trends and opportunities.

How do commodity prices affect Indian equities?

Commodity prices, like oil and metals, influence Indian stocks. They impact sectors like energy and FMCG, making them sensitive to price changes.

What is the significance of foreign institutional investor activity in the Indian market?

FII activity is vital in the Indian market. Their buying and selling affect index movements and investor mood. It’s important to watch their actions.

Which sectors are expected to perform well in 2025?

IT, pharmaceuticals, banking, and infrastructure sectors look promising in 2025. They’re driven by digital growth, innovation, and government support, attracting investors.

How can investors navigate market volatility?

To handle market ups and downs, try short-term trading or long-term investing. Use risk management like diversification and stop-loss orders to protect your investments.

What are the possible challenges to Nifty’s sustained growth above 25,000?

Nifty’s growth above 25,000 faces challenges like global downturns and domestic slowdowns. Geopolitical tensions also pose risks, affecting investor confidence and market performance.

How do geopolitical factors influence Indian market sentiment?

Geopolitical events, like elections and trade disputes, create uncertainty in India. They impact investor confidence, making it key to monitor these factors.

![AI Writing Tools Compared: ChatGPT vs Jasper vs Writesonic [2025]](https://niftynautanki.com/wp-content/uploads/2025/09/img-00998-120x86.png)